Navigating the intricate entire world of taxation is usually complicated For a lot of people and companies alike. Tax obligations can rapidly become overwhelming, bringing about a necessity for successful tax relief procedures. Tax reduction refers to the many procedures and mechanisms through which taxpayers can reduce the level of tax owed or delay tax payments. These procedures can provide much-desired fiscal reprieve, especially for All those dealing with mounting tax debts. Understanding tax reduction options is important in making certain that taxpayers are usually not burdened by their tax liabilities, making it possible for them to manage their finances extra efficiently.

One widespread state of affairs in which tax aid becomes vital is when people today or organizations are combating significant tax financial debt. In these cases, tax resolution turns into an important Resource. Tax resolution involves negotiating with tax authorities to settle tax debts, frequently leading to a reduction of the whole total owed. This method demands a deep idea of tax laws along with a strategic method of dealing with tax authorities. Tax resolution usually takes quite a few forms, including installment agreements, gives in compromise, and penalty abatements. Each of those methods delivers a distinct pathway to resolving tax difficulties, according to the specific circumstances in the taxpayer.

A noteworthy scenario that highlights the significance of tax relief and tax resolution is Doe vs. Tax Rise Inc. This situation exemplifies the problems that taxpayers can face when addressing tax authorities. In Doe vs. Tax Increase Inc., the taxpayer was to begin with overcome with the needs of your tax authority, leading to sizeable tension and money strain. However, through a perfectly-planned tax resolution approach, the taxpayer was ready to negotiate a more favorable end result. The situation of Doe vs. Tax Rise Inc. serves for a reminder that helpful tax resolution will make a significant big difference in the end result of tax disputes.

When contemplating tax aid, it is necessary to acknowledge that not all relief options are produced equal. Some solutions, for instance tax deductions and credits, right reduce the amount of tax owed, while some, like deferments, delay the payment of taxes. Taxpayers really need to evaluate their situation thoroughly to determine which tax aid tactics are most ideal. As an example, a taxpayer dealing with rapid economic hardship may perhaps get pleasure from a deferment, whilst anyone with significant deductions may possibly prefer to concentrate on maximizing People to reduce their tax liability. Knowledge the nuances of those solutions is essential to creating knowledgeable conclusions about tax relief.

Tax resolution, Then again, generally involves Experienced aid. Negotiating with tax authorities can be a complex and scary system, and having a highly skilled tax Qualified in your facet will make a big variance. In several instances, tax resolution experts can negotiate superior terms in comparison to the taxpayer could accomplish on their own. This was evident in Doe vs. Tax Increase Inc., the place the taxpayer's thriving resolution was mostly due to the experience of their tax advisor. The case underscores the significance of searching for Experienced assist when handling major tax issues.

Along with Skilled assistance, taxpayers should also concentrate on the assorted resources available to them for tax reduction. These applications can incorporate tax credits, deductions, and also other incentives built to minimize tax liabilities. For instance, tax credits immediately cut down the amount of tax owed, earning them one among the simplest forms of tax reduction. Deductions, Alternatively, cut down taxable earnings, which could decreased the general tax Monthly bill. Knowing the distinction between these instruments And just how they are often utilized is essential for powerful tax setting up.

The Doe vs. Tax Rise Inc. scenario also highlights the value of remaining informed about tax legal guidelines and polices. Tax laws are regularly switching, and what might are a feasible tax relief or tax resolution system up to now may well not be relevant. Taxpayers will need to stay up-to-day with these changes to be certain These are Benefiting from all available tax reduction choices. In the situation of Doe vs. Tax Rise Inc., the taxpayer's familiarity with latest tax regulation adjustments was instrumental in achieving a good resolution. This circumstance serves like a reminder that being informed may have a significant effect on the result of tax disputes.

An additional important aspect of tax reduction and tax resolution could be the timing. Acting promptly when tax difficulties crop up can avoid the problem from escalating. In Doe vs. Tax Increase Inc., the taxpayer's timely response for the tax authority's calls for performed an important function while in the thriving resolution of the Doe vs. Tax Rise Inc. situation. Delaying action can result in added penalties and fascination, earning the situation even harder to solve. For that reason, it can be important for taxpayers to deal with tax challenges once they crop up, rather than waiting until the issue turns into unmanageable.

Although tax relief and tax resolution can provide significant Advantages, they are not without their challenges. The procedure is often time-consuming and involves an intensive knowledge of tax regulations and regulations. On top of that, not all tax aid possibilities can be found to each taxpayer. Eligibility for selected kinds of tax relief, for instance delivers in compromise, is usually restricted to individuals who can show financial hardship. Equally, tax resolution methods may perhaps range according to the taxpayer's financial condition and the nature in their tax debt.

Irrespective of these difficulties, the opportunity benefits of tax reduction and tax resolution are sizeable. For most taxpayers, these strategies can indicate the distinction between economic security and ongoing financial pressure. The situation of Doe vs. Tax Increase Inc. is really a testomony into the usefulness of those tactics when used properly. By using a proactive method of tax reduction and tax resolution, taxpayers can regulate their tax liabilities much more properly and steer clear of the severe implications of unresolved tax financial debt.

In conclusion, tax reduction and tax resolution are vital parts of productive tax administration. They offer taxpayers While using the tools and strategies needed to decrease their tax liabilities and resolve tax disputes. The situation of Doe vs. Tax Increase Inc. illustrates the necessity of these procedures in acquiring favorable results. By keeping knowledgeable, searching for Skilled help, and acting instantly, taxpayers can navigate the complexities with the tax process and safe the economic relief they need. Whether through tax credits, deductions, or negotiated settlements, tax aid and tax resolution give you a pathway to economic stability for people experiencing tax problems.

Scott Baio Then & Now!

Scott Baio Then & Now! Josh Saviano Then & Now!

Josh Saviano Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now! Kane Then & Now!

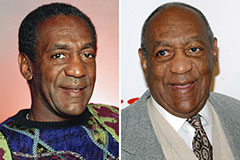

Kane Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!